Funding rules

- mind. ein sächsischer und ein tschechischer Projektpartner (nicht zwingend aus der Euroregion oder dem Fördergebiet)

- Projektergebnisse müssen dem Fördergebiet von INTERREG Sachsen-Tschechien zugutekommen (siehe unten)

- gemeinsame Planung und Durchführung des Projektes mit Personal beider Partner

- Gesamtausgaben max. 30.000 Euro, min. 1.000 Euro bei der Abrechnung über Standardeinheitskosten bzw. 3.000 Euro bei der Abrechnung über das Entwurfsbudget

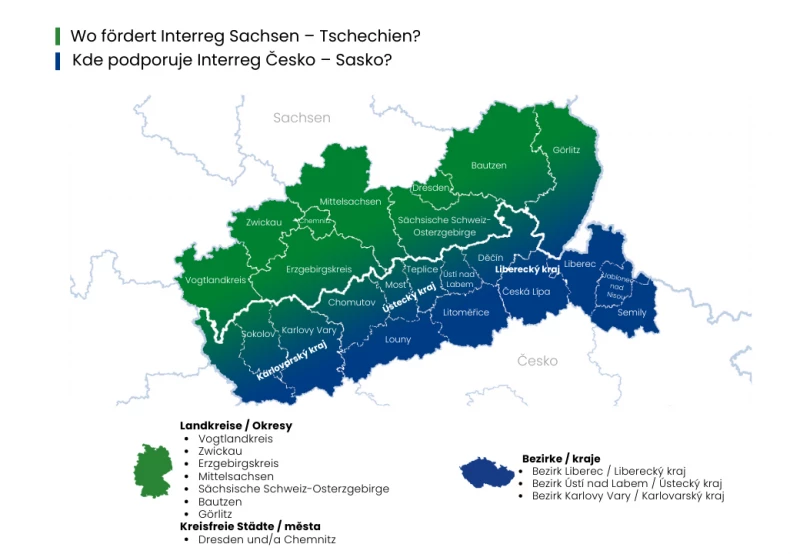

Fördergebiet von INTERREG Sachsen-Tschechien

Welche Ziele muss das Projekt unterstützen?

- Begegnungen zwischen den Bürgern beiderseits der Grenze verstärken

- sprachliche und interkulturelle Kompetenzen weiter fördern

- gegenseitiges Verständnis durch eine verstärkte Vertrauensbildung und den Abbau mentaler Hemmnisse weiter erhöhen

- Wissen der Menschen über das Nachbarland erweitern

Was ist förderfähig?

- Organisation und Durchführung von grenzübergreifenden Veranstaltungen wie Workshops, Seminaren, Konferenzen, Informationsveranstaltungen, Erfahrungsaustausche, Vernetzungstreffen, Wettbewerbe, Sport- und Kulturveranstaltungen

- Gruppenaustausch, insbesondere Austausch von Kinder-, Jugend-, Studenten- und Schülergruppen

- Bildungsmaßnahmen inkl. Sprachmodule zur Erhöhung von Sprachkompetenzen

- Projekte der Öffentlichkeitsarbeit im Rahmen von Begegnungen wie das Erstellen von mehrsprachigen Publikationen und Informationsmaterialien oder gemeinsamer Informations- und Kommunikationssysteme

...und was nicht?

- reine Sprachkurse

- parteipolitische Aktivitäten

| in Sachsen | in Tschechien |

|

|

Förderhöhe

Die Förderung kann bis zu 80 Prozent der förderfähigen Gesamtkosten betragen. Bei wiederholten Projekten ist es möglich, dass der Fördersatz sinkt (auf 70% bzw. 50%).

Die Förderung beträgt höchstens 20.000 Euro. Die Gesamtkosten können maximal 30.000 Euro betragen.

Projekte mit einer feststellbaren Teilnehmerzahl werden nach Kopfpauschalen (offiziell Standardeinheitskosten) abgerechnet, alle anderen über ein Entwurfsbudget.

Projekte mit Gesamtkosten von weniger als 1.000 Euro bei der Abrechnung über Kopfpauschalen bzw. 3.000 Euro bei der Abrechnung über das Entwurfsbudget sind nicht förderfähig.

Die Erstattung der Kosten erfolgt nur dann, wenn die ordnungsgemäße Durchführung des Kleinprojektes nachgewiesen wurde. Die Förderung erfolgt nach dem Erstattungsprinzip, also erst nach dem Ende der Projektes.

Einnahmen

Einnahmen, die während der Projektlaufzeit oder nach Projektende erwirtschaftet werden, bleiben im Zuge der Feststellung der Gesamtausgaben unberücksichtigt.

Projekte mit einer feststellbaren Teilnehmerzahl werden nach Kopfpauschalen (offiziell Standardeinheitskosten) abgerechnet. Das ist sehr einfach: Für jede teilnehmende Person gibt es pro Tag (sog. Personentag) einen festgelegten Pauschalsatz. Damit sind alle Kosten abgedeckt. Einzelne Ausgaben können nicht mehr abgerechnet werden.

Die Kopfpauschale unterscheidet sich nach Typ des Projektes. Er werden drei Typen unterschieden:

- Veranstaltungen: Grenzübergreifendes Zusammentreffen in allen Bereichen des gesellschaftlichen Lebens wie z. B. sportliche und kulturelle Veranstaltungen, Gruppenaustausche als auch Trainings- und Ferienlager u.a.

- (Fort-)Bildungen: Grenzübergreifendes Zusammentreffen von Personen mit Bildungscharakter, wie z.B. Sprachmodule zur Erhöhung von Sprachkompetenzen oder Workshops, Seminare und Schulungen zu speziellen Themen, bei denen Kenntnisse vermittelt werden, unabhängig davon, ob theoretisch oder praktisch. Ziel ist es, die Kompetenz der Teilnehmer auf einem konkreten Fachgebiet zu erhöhen.

- Fachkonferenzen: Grenzübergreifendes Zusammentreffen von Experten aus einem bestimmten Fachbereich, die in Referaten ihre Arbeit und Erkenntnisse vorstellen und untereinander diskutieren. Es findet ein fachlicher Informations- und Erfahrungsaustausch über ein konkretes Fachgebiet statt.

Die aktuellen Pauschale für die drei Projekttypen sind folgende:

| Projekttyp | Kostensatz EUR/ Personentag seit 1.2.2024 |

|---|---|

| Veranstaltungen | 53 EUR |

| (Fort-)Bildungen | 76 EUR |

| Fachkonferenzen | 105 EUR |

Diese Sätze werden jährlich im Februar der Inflation angepasst. Es gilt immer der Satz zum Zeitpunkt der Antragstellung, nicht der zum Zeitpunkt der Durchführung oder Abrechnung.

Für Projekte, die sich bereits in Durchführung oder Abrechnung befinden, gelten die bisherigen Sätze der Kopfpauschalen:

| Projekttyp |

Kostensatz |

|---|---|

| Veranstaltungen | 49 EUR |

| (Fort-)Bildungen | 70 EUR |

| Fachkonferenzen | 96 EUR |

Kleinprojekte mit einer nachweisbaren Anzahl von Teilnehmern, deren Gesamtkosten weniger als 1 000 EUR betragen, werden bei der Abrechnung nicht berücksichtigt.

Weitere Einzelheiten sind im Umsetzungsdokument in Anhang Nr. 1 zu den Standardeinheitskosten zu finden.

Projekte, bei denen keine konkrete Teilnehmerzahl feststellbar ist, werden in Form eines sog. Entwurfsbudgets abgerechnet. Dabei wird eine Kostenplanung der konkreten Ausgaben eingereicht. Daraus wird ein Kostensatz bezogen auf ein konkretes Projektergebnis berechnet. Wird dieses Ergebnis erreicht, erfolgt die Auszahlung der Mittel. Andernfalls geht der Projektträger leer aus.

Begegnungsprojekte mit nicht nachweisbarer Teilnehmerzahl können u.a. folgende Veranstaltungen sein:

- Festivals und Konzerte,

- Märkte und Jahrmärkte,

- Erntedankfeste,

- öffentliche Feierlichkeiten

- Kulturveranstaltungen,

- Ausstellungen,

- Tag der offenen Tür usw.

Kleinprojekte mit einer NICHT nachweisbaren Anzahl von Teilnehmern, deren Gesamtkosten weniger als 3 000 EUR betragen, werden bei der Abrechnung nicht berücksichtigt.

Weitere Einzelheiten sind im Umsetzungsdokument in Anhang Nr. 2 zu den Draft budget zu finden.

Der Projektzeitraum beginnt frühestens mit der Einreichung des Projektantrages beim Fondsverwalter und beträgt in der Regel ein Jahr.

Mit dem Vorhaben darf begonnen werden, sobald das Projekt registriert worden ist. Die Registrierung erfolgt nach formaler Kontrolle und positiver Prüfung der fachlichen Förderfähigkeit. Als Beginn des Vorhabens gilt die erste rechtliche Verpflichtung zur Bestellung von Ausrüstung oder Inanspruchnahme von Dienstleistungen oder eine andere Verpflichtung, die das Vorhaben unumkehrbar macht. Jeder frühere Projektbeginn führt dazu, dass das gesamte Projekt nicht förderfähig ist!

Bis zum Zeitpunkt der Bewilligung (Abschluss des Zuwendungsvertrages) tragen die Antragsteller ihre Kosten auf eigenes Risiko. Ein Anspruch auf Förderung besteht nicht.

Das Projekt muss durch den Lokalen Lenkungsausschuss bewilligt werden.

Die Zusage der Fördermittel erfolgt durch den Abschluss eines Zuwendungsvertrages zwischen dem Antragsteller und dem jeweils zuständigen Fondsverwalter. Der Zuwendungsvertrag begründet keinen automatischen Anspruch auf Auszahlung der Zuwendung. Dafür muss auch die Abrechnung in Ordnung sein.